Distributing Zakat in accordance with Sharia

At Islamic Relief Canada (IRC), we have developed a Scholar Verified Zakat Policy to ensure that our Zakat activities are executed in full accordance with the teachings of Islam.

The policy establishes a consistent and unified approach so that Islamic principles are adhered to every step of the way from project design and community fundraising discussions to project implementation. It also works to maximize the impact of Zakat within our programs, allowing your Zakat to reach as many poor and needy people as possible to transform their lives.

Ultimately, it enables us to fulfill our obligation and the trust we owe to you as a donor in the best way possible.

OUR KEY OBJECTIVES

Governance & Accountability

Ensuring appropriate governance from theological and federal laws for the management of charitable/Zakat funds, including documented processes for financial accountability, and regular consultation with scholars.

Maximizing Impact & Efficiency

Developing Zakat eligible projects in compliance with Islamic principles, and utilizing Zakat within our programs in a manner that ensures the maximum impact and efficiency in reducing suffering and poverty.

Clear Guidance & Communications

Providing centralized and clear internal guidance to IRC’s board, management, and staff on how Zakat should be fundraised, accounted for, allocated, distributed, and monitored; as well as external transparency and accountability to our donors and stakeholders on how we collect and distribute Zakat.

Frequent Monitoring & Reporting

Ensuring regular internal project reporting, and providing regular stewardship touchpoints for donors to improve transparency on the impact of Zakat funds and activities.

Our Collection of Zakat

In the process of collecting Zakat, IRC staff undertake comprehensive efforts to educate local Muslim communities on the significance of paying Zakat and those who are responsible to do so. To facilitate this process, the team seeks to offer clear and accessible guidelines, supported by materials and online tools, which are developed in consultation with Canadian Imams and scholars.

Additionally, IRC provides training to staff and volunteers on the obligation to pay Zakat, basic elements of calculating Zakat, organizational protocols in managing and reporting on Zakat, and clarity on Zakat eligibility for our projects.

When collecting Zakat, IRC maintains separate and traceable accounting records to distinguish the income and spend from Zakat, and ensures that funds are only spent on what is Zakat eligible.

Marketing & Fundraising

In the case of Zakat, our policy is to advocate for donors to contribute to a general Zakat fund as much as possible. This helps enable swift and effective expenditure of Zakat donations, without additional restrictions. Since the obligation of paying Zakat is not fully discharged until the rights holder receives the funds, donors should be advised against placing conditions on Zakat that may prevent it from being spent in the most quick and effective manner on those who need it most.

However, we place paramount importance on donor intent, and consistently aim to adhere to donor intent with every donation that is spent. In cases where IRC cannot honour donor wishes, such as due to project availability or conflicting conditions, the organization must either communicate the limitation to the donor and suggest contributing their Zakat to an alternative fund, or, if necessary, refuse the donation due to incapacity to meet the specified conditions.

Our Distribution of Zakat

Who is eligible to receive Zakat?

The Qur’an clearly outlines the eight categories of people who are eligible to receive Zakat. As such, IRC will only distribute Zakat to rights holders (directly or through projects) making sure there is some form of ownership for the categories outlined below. When allocating Zakat to projects, IRC will maintain records as to how this project matches the criteria of Zakat.

Categories

Islamic Relief identifies those who are well below Nisab, working with the poorest of the poor and those who are most vulnerable in the face of conflict and disaster. This includes orphan households, single female-headed households, people with disabilities, and the elderly.

IRC is committed to utilizing Zakat funds to meet the essential needs of rights holders, emphasizing emergency relief activities such as providing food, shelter, clothing, medication, healthcare, water, and sanitation.

Where possible, Zakat should also be utilized in a way that provides long-term solutions to the deprivations or needs of disadvantaged people. This could be achieved through developing sustainable livelihood projects, education, health provision, or supporting other sustainable development activities for the poor and needy.

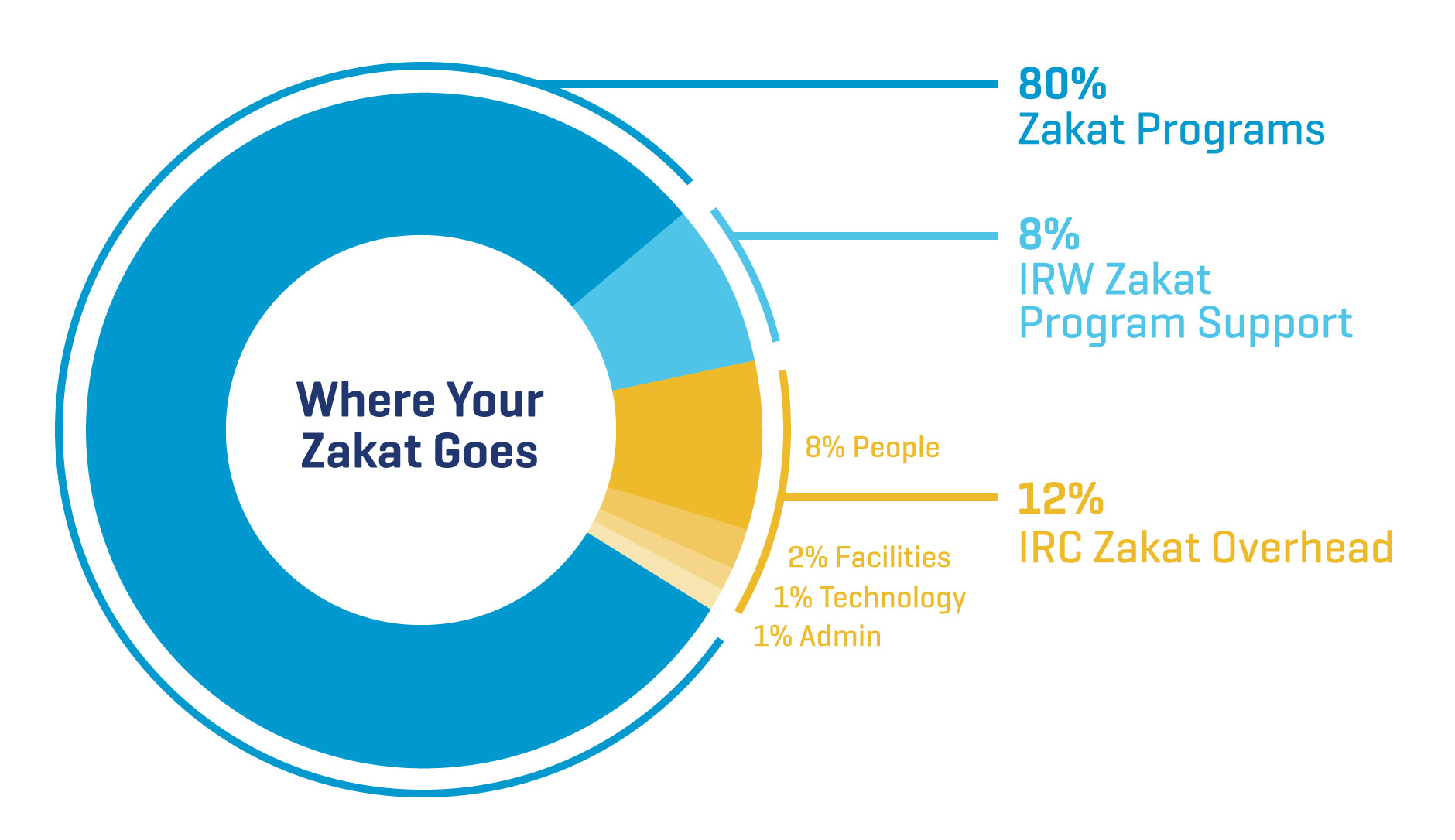

As a legitimate administrator of Zakat, IRC assumes the role of a duty-bearer with the obligation to respect, protect, and fulfill the rights of rights holders for whom Zakat funds have been collected. The organization is entitled to allocate a reasonable portion, up to 20% (between IR Canada and IR Worldwide collectively), of Zakat funds to cover the costs associated with the delivery of Zakat-eligible projects.

We are committed to ensuring resources are used responsibly and efficiently. This is why we provide 88% of all collected Zakat to directly fund Zakat activities and uplift the lives of our rights holders. This includes the 8% that is provided to our Zakat-eligible implementing partner, Islamic Relief Worldwide (IRW), to directly support program implementation costs and operations in the field.

As such, IRC allocates the remaining 12% of Zakat funds to cover its management and administrative costs for Zakat implementation. This primarily includes paying for people, facilities, and technology to facilitate the trustworthy collection and delivery of Zakat.

Whilst IRC is inspired by its Islamic values, and proactively seeks to educate our supporters regarding these values and teachings on poverty alleviation, as a humanitarian agency we do not engage in any proselytization activity. As such, IRC does not undertake any Zakat activities under this category.

The use of Zakat funds can rightfully be used for the emancipation of slaves. While projects of this nature are not the primary focus of Zakat spending for IRC, where IRC finds people suffering from a modern form of slavery – such as bonded labour, forced labour, or human trafficking – Zakat funds may be utilized to emancipate people from such forms of slavery (provided that the funds do not profit perpetrators of such acts who have violated national or international law).

Zakat may be used to assist those in debt under specific conditions. Eligible recipients must genuinely require financial aid, excluding those with sufficient wealth to cover their debts. While recipients do not necessarily need to be destitute, they should lack the income or wealth necessary to repay their debt promptly.

Also, the debt should be due immediately. Those whose debts can be deferred may still be eligible to receive Zakat but could be considered as less of a priority than those who need immediate assistance. IRC relies on its implementing partners to use processes and criteria that verify that only those in genuine debt are supported, with the understanding that IRC should have access to relevant information when necessary.

In the spirit of fulfilling our Islamic responsibilities and adhering to the principles of Zakat, we acknowledge the significance of the concept of Tamleek (ownership) in the distribution of Zakat funds. Tamleek, an essential Islamic principle, emphasizes the transfer of ownership or possession to the rightful rights holders. This principle ensures that Zakat, as a form of worship and social welfare, directly assists those in need by providing them with a degree of ownership or control over the resources provided.

In light of this, and guided by esteemed scholarly advice, our policy on the utilization of Zakat funds for community projects such as schools and hospitals is crafted with careful consideration of Tamleek. We recognize that community projects serve a vital role in uplifting and supporting Zakat-eligible individuals and their communities. Therefore, our approach is to ensure that these projects, while communal in nature, incorporate the element of Tamleek.

IRC takes the supported opinion that it is permissible to fund communal welfare assets and programs, such as clean water sources, health clinics, education facilities, and agricultural initiatives, in order to alleviate poverty and hardship in disadvantaged communities. These projects aim to empower communities through ownership, subject to specific conditions.

Furthermore, IRC will use Zakat to fund essential service providers, including teachers, doctors, health workers, disaster recovery personnel, trainers, and agriculture specialists who directly address the needs of rights holders. This funding is subject to conditions and ensures that Zakat is utilized effectively to directly benefit rights holders in need, aligning with IRC's commitment to responsible and impactful resource allocation.

IRC defines travelers as people who are at least 48 miles away from their home and unable to reach their destination (including refugees and internally displaced people) and who have been cut off from their wealth, assets, or source of income. IRC may use Zakat funds to address the diverse needs of the travelers, encompassing provisions for sufficient food, clothing, shelter, transportation, education, healthcare, and any other necessities they may require.

Zakat Policy: Certifications

Islamic Relief’s Zakat policy has been reviewed and confirmed to be in accordance with Shari’a by Sheikh Abdullah al-Judai.

Islamic Relief’s Zakat policy has been reviewed and confirmed to be in accordance with Shari’a by Mufti Abdul Qadir Barkatulla (Sharia Judge at Islamic Sharia Council, London).

Islamic Relief’s Zakat policy has been reviewed and confirmed to be in accordance with Shari’a by Sheikh Mohammad Akram Nadwi.

Matters Relating to the Allocation & Distribution of Zakat

As part of this policy, we also outline our approach to the allocation and distribution of Zakat in Canada. The organization may research and identify levels of poverty in the country and, upon recognition of need, develop strategies to utilize Zakat funds domestically. The Board of Directors (BOD) will determine the specific amount allocated for this purpose.

IRC emphasizes that funds will not be distributed equally among Zakat categories, as some may not apply to its mission. Instead, allocations will be based on the need of right holders and the organization's capacity in each geographical location. IRC aims to distribute Zakat funding within a year of receiving it, prioritizing swift utilization, and prohibits the use of Zakat for endowments, investments, loans, or business enterprises. The organization believes Zakat can be utilized for both short-term (e.g., immediate humanitarian responses) and long-term projects (such as multi-year livelihood programs).

In conclusion, this policy underscores IRC's unwavering commitment to fulfilling Zakat responsibilities while upholding transparency and compliance with Islamic principles and Canadian laws. It ensures that Zakat funds are channeled toward their intended purpose – alleviating poverty and protecting the rights of the needy.